Fighting Back Against Errors: Rights to Faster Dispute Resolution and Compensation

In today’s data-driven financial environment, a Credit Score or Rank represents one of the most valuable financial assets an Individual

Can Algorithm-Based Credit Decisions Replace Traditional Credit Officers?

The evolution of lending has always reflected the evolution of information. In earlier decades, credit officers relied primarily on manual

RBI Ombudsman: Really a Last Resort?

When borrowers hit a wall with banks or NBFCs, the phrase “Go to the RBI Ombudsman” is often suggested as

Why Process Optimization is a Competitive Advantage in the Lending Ecosystem?

The lending industry is undergoing a structural transformation. Banks, NBFCs, HFCs, and fintechs are no longer operating in isolation; they

Affordable Housing and the Union Budget: Why Affordability Is Still Elusive

As markets look ahead to the Union Budget being presented each February, affordable housing once again finds itself at the

The Price of a Low Credit Score in India

In India, a Credit Score has become a reflection of your financial character, a silent judge that influences far more

Credit Bureaus Never Forget

A few years ago, Aryan, a young professional from Mumbai, missed a few credit card payments. At that time, he

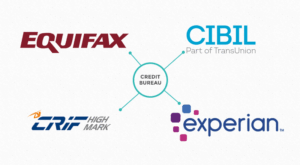

Credit Bureaus from the eyes of the Borrower

Credit Bureau assigns a 3 digit number called as credit score which ranges from 300 to 900. It serves as

Housing Finance: Traditional vs. Modern Lending Practices

The dramatic transformation of the housing finance landscape, from traditional to digital and customer-centric approaches, underscores the increasing importance of